CPA - medium firm

Other

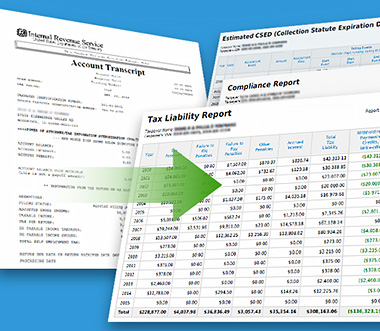

This program will show you how to generate more revenue representing your clients before the IRS Collection division, utilizing the all-in-one tax resolution software. No case is too complex for PitBullTax Software. Programmed with proprietary analytic and diagnostic logic, PitBullTax Software eliminates the guesswork out of strategizing and building a successful case. With its user-friendly data entry format, information is seamlessly calculated and populated into all necessary IRS forms and supplementary schedules to prepare: Offers in Compromise, Installment Agreements, Appeals, Currently Not Collectible cases, Innocent and Injured Spouse Relief cases, Taxpayer Advocate Assistance cases and so much more! When circumstances change, so too can your resolution with a few simple key strokes. With integrated IRS Transcripts Delivery and Reporting PitBullTax Software is the key to a successful tax resolution practice.

Learning Objectives

- Learn how to increase your efficiency and optimize day-to-day processes

- Leveraging software to increase ROI on tax resolution cases

- Financial analysis of IRS collection outcomes

- Tax resolution process and workflow efficiencies

- Side-by-side comparison of Tax Resolution options such as Offer in Compromise, Installment Agreement and Currently Not Collectible case

Taylor Goddard

PitBullTax Software

Sales and Customer Service Executive

[email protected]

(877) 474-8285

Taylor is a Sales and Customer Service Executive at PitBullTax Software bringing ten years' experience in the field. Specializing in Client Acquisition, Retention and Sales he focuses on assuring an enjoyable customer experience as well as streamlined problem resolution. With a deep understanding of our software combined with a strong sense of customer loyalty he is a valuable member of the PitBullTax pack. Being a family man, he enjoys spending time with them in his free time.

Irina N Bobrova, MST, EA, CAA, NTPI Fellow

PitBullTax Software

COO

[email protected]

(877) 474-8285 x107

Irina Bobrova is an Enrolled Agent, Certifying Acceptance Agent and NTPI Fellow and proud that her vast financial training and tax experience has given her the knowledge and tools necessary to analyze and understand multi-faceted tax problems and find targeted tax collection resolutions that work. In her tax resolution practice, Irina has helped hundreds of taxpayers to resolve their tax problems, and particularly excelled in preparing Offer in Compromise cases with successful outcomes. To strengthen her tax knowledge, Irina Bobrova earned her Master of Science in Taxation degree from Northeastern University, Boston MA, which has one of the best graduate tax programs in the country.

As Chief Operating Officer and Program Analyst for PitBullTax Software, the leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys, she spent years researching IRS regulations and procedures on collection issues and advising tax professionals nationwide on how to prepare successful cases. She also puts her experience to use for the greater good as a regular volunteer at the Low Income Taxpayer Clinic of the Legal Aid Service of Broward County of Florida, helping disadvantaged and financially challenged Floridians for free. Irina’s teaching career includes numerous live webinars for tax professionals and live presentations at various tax conferences. She has taught CPE webinars and live programs for the audiences of ASTPS American Society of Tax Problem Solvers) and Broward Chapter of the FSEA (Florida Society of Enrolled Agents).